Larsen & Toubro (L&T): Company Analysis Report

1. Company Overview

Founded in 1938, headquartered in Mumbai, India, Larsen & Toubro (L&T) is one of the largest and most diversified engineering, procurement, and construction (EPC) conglomerates in India. It is the nation builders. The complete businesses of the company can be viewed in the given link https://www.larsentoubro.com/corporate/our-businesses/

The key sectors of the company are

Infrastructure, Energy, Hi-Tech Manufacturing, IT & Technology Services,

Financial Services, Development projects and others. With changing global trends, The company Group's businesses and

offerings are closely linked to global megatrends. Sharing a snapshot of the

same.

As can be seen the list is long and covers the entire growth spectrum. L&T

operates globally in over 50 countries, serving government and private sector

clients.

For more details, click the company website https://www.larsentoubro.com/. Also, the Annual report is available in this shared link. https://investors.larsentoubro.com/Annual-Reports-Archives.aspx

2. Key Financial Highlights.

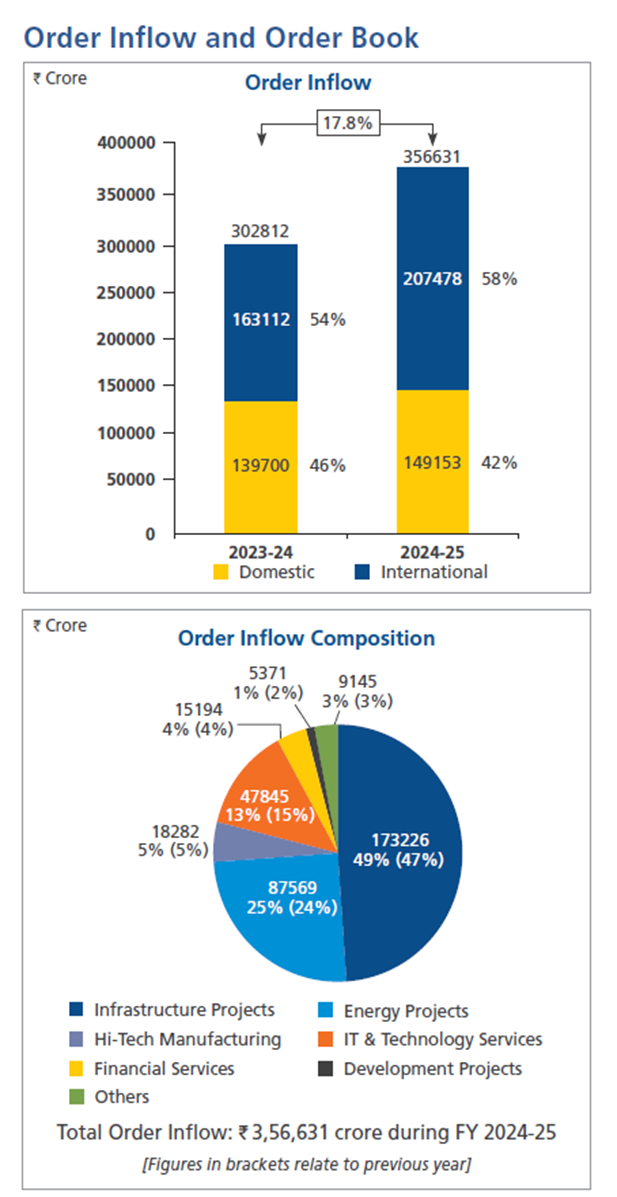

Order Inflow - In the below snapshot, it can be seen there is an increase of 17.8% increase in order inflow which is about 54,000 crores which is huge. In billion-dollar terms, it will be around 6.5 billion US dollars. Total order inflow is 3.5 lac crore for year 2024-25 which is also very huge. As can also be seen, the international order inflow is higher than the Domestic (India) order book.

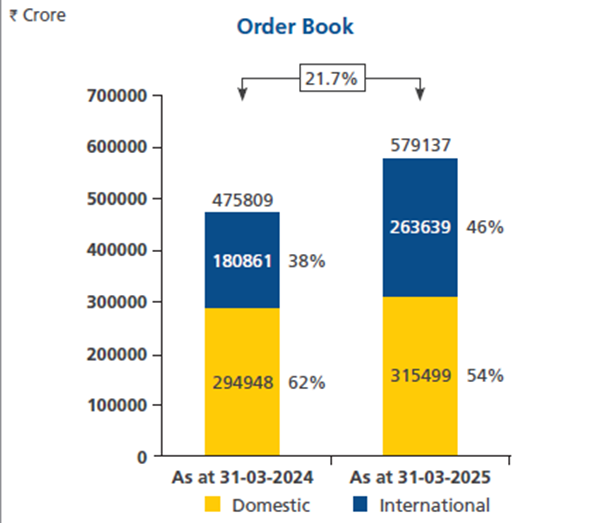

Order Book details. The current order book stands at 5.79 lakhs crores. The order book has grown at 21.7%.

|

Metric |

FY24 |

FY25 |

YoY Growth |

|

Revenue |

2,21,113 cr |

2,55,734 cr |

15.7% |

|

Net Profit |

15,547 cr |

17,673 cr |

13 % |

|

Order Inflow |

3,02,812 cr |

3,56,631 cr |

17.8% |

|

Order Book |

4,75,809 cr |

5,79,137 cr |

21.7% |

Other key parameters are, ROCE is 14.5%, ROE 16.6% (above 15), debt/equity ratio 1.36, current P/E 32 which is slightly lower than 3-year median PE of 33.8

3. Share price performance

The share price has grown at a CAGR of 30.59% over a period of 5 years. Sharing the price chart over the period.

4.Business Mix (FY24 Revenue Contribution)

- Infrastructure: 43%

- Hydrocarbon: 22%

- Power & Heavy Engineering: 9%

- IT & Technology Services (LTI Mindtree): 18%

- Financial Services & Others: 8%

5.Growth Drivers

- Indian infrastructure push (NIP, PM Gati Shakti) There is India's Infrastructure boom. India's National Infrastructure Pipeline (NIP) was launched with an initial sanctioned investment plan of ₹111 lakh crore (US$1.4 trillion) covering the period from FY2020-2025. With India's continued Infra push, this is expected to increase and continue.

- Defense indigenization & smart

cities

- Green energy, water, and smart infrastructure projects

- Power capacity surge: FY24 saw a 7.2% rise in capacity, including 15.8% growth in renewables (>209 GW), targeting 500 GW by 2030

- Smart city rollout & urban housing: Over 1.6 lakh crores worth of projects under Smart Cities Mission; PMAY‑U housing aims for ~1 crore homes

- Logistics push: Strong impetus via PM Gati Shakti, Multimodal Logistics, Sagarmala, and urban development funds

|

Sector |

Outlook |

|

Roads & Highways |

↑ Strong -expressways, Gati Shakti pipelines |

|

Rail & Metro |

↑ Robust -freight corridors & bullet

train |

|

Power & Renewables |

↑ Promising -transmission & green energy |

|

Urban Infrastructure |

↑ High -smart cities, housing, logistics |

|

Digital Adoption |

↑ Accelerating -tech-driven projects |

6. Key Risks

- Execution delays & cost overruns

- Commodity price inflation

- Regulatory/political risk

- Dependence on government infrastructure spending

- Dependence on International orders, L&T's order book is significantly influenced by international markets, with a strong presence in the Middle East. A large portion of this, about 85%, is from the Middle East. Within the Middle East, Saudi Arabia, the UAE, and Qatar are key markets. Specifically, Saudi Arabia accounts for a substantial 25% of L&T's international order inflow.

- Rising competition from global EPC and tech players

7. Valuation & Outlook

L&T currently trades at a P/E of ~32x, reflecting investor confidence in its strong order pipeline and diversified operations.

8. Conclusion

L&T stands as a core infra-tech proxy

in India's economic growth story. Its diversified order book, strong project

execution, and expansion into technology and sustainability projects make it

attractive for long-term-focused investors.

Disclaimer: This report is for educational purposes only. It does not

constitute investment advice. Please consult a SEBI-registered adviser before

making investment decisions.

Shailendra Kumar AMFI ARN no. -316269

"See this piggy bank. Incubate the habit of Savings. Become a millionaire."