KPIT Technologies: Company Analysis

1.

Company Overview

KPIT Technologies is the "Largest Independent Software and

System Integration Partner to the Mobility Ecosystem". Today, Cars/Vehicles

are going autonomous with self-driving features. These cars have more computer

in them than ever before. Vehicle manufacturers are embedding more and more

software in them to make the vehicle autonomous. -KPIT plays a big part in this automation.

KPIT positions itself as a global leader in mobility software.

It's focus areas are Electric Vehicles (EVs), Autonomous Driving and ADAS, Body

Electronics, Vehicle Diagnostics and Connected Vehicles. It's expertise lies in Autonomous Driving &

ADAS, Body Electronics, Chassis, Cockpit, Propulsion, E/E Architecture, Network

& Middleware, Cloud, Edge analytics & Data management, Vehicle

Engineering & Design, Virtual Engineering, Integrated Diagnostics &

Aftersales Transformation [iDART] and Validation.

Its key clients include BMW, Mercedes, Stellantis, Renault, Honda,

Ford, Jaguar, General Motors, Volkswagen, Renault, Cummins, Navistar. The top

end vehicle manufacturers.

It has a Global presence in Europe, USA, Japan, China, South

Korea, Vietnam, Thailand, Brazil and India. The top countries where the best

vehicles are manufactured.

2.

Background

In 2019, the company was demerged from Birlasoft

ltd with focus on engineering and mobility solutions

3.

Sector Outlook

Currently in today's vehicles, contribution of automation

continues to increase. A breakup of such costs are

given below.

- Average contribution of software:

-> 15-20% of a car's total cost (for mid-range and premium vehicles)

-> Up to 30%+ in EVs or advanced driver assistance systems (ADAS)-enabled cars - In premium or electric models (e.g.,Mercedes

EQS, BMW iX):

-> Software can account for up to 100 million lines of code

-> Software + electronics = 40-50% of vehicle cost

Five years going forward, software + electronics will be 60%

of the vehicle cost. KPIT technologies is expected to play a big part in this

automation. Research reports suggest the total spend on software by the automotive

and mobility industry would be in the range of around $46+ billion by 2030.

This is a very bright sector with compounding growth in the

future.

4.

Financial Highlights:

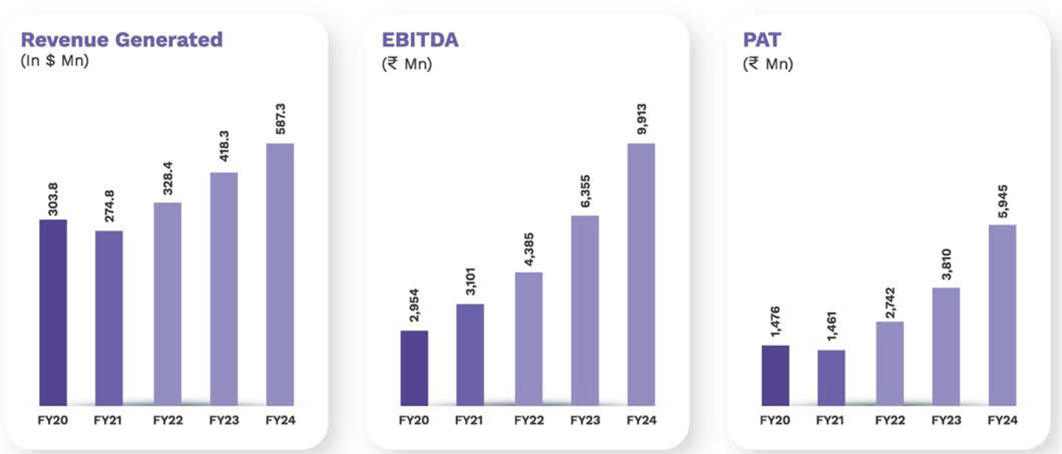

Sharing yearly charts for the financial growth of KPIT

technologies. As can be seen, the company has witnessed stupendous growth in

terms of revenue, EBITDA, PAT and ROE.

Revenue: Except for one covid year, the annual revenue and PAT

(profit after tax) has been on the upside. Also, EBIDTA has been on a constant

uprise.

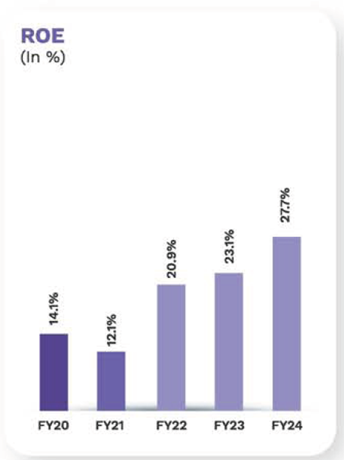

Also, the ROE has been on a constant uprise.

Anything above 15% is considered good. In

finance, Return on Equity (ROE) is a profitability ratio that measures how well

a company uses investments to generate earnings for shareholders. There is

tremendous potential in this company.

4. Stock Snapshot (As of 4 July 2025)

|

Share Price |

₹1264 |

|

Market Cap |

₹ 34,720Cr+ |

|

P/E Ratio |

41.4 |

|

3-Year

Median PE |

67.5 |

|

3-Year

Stock CAGR |

~60%+ |

|

Promoter

Holding |

~40% |

|

FII/DII

Holding |

~35%+ |

Valuations reflect high-growth, niche positioning in mobility

software. It is currently valued less than the 3-year median PE.

Sharing the 5-year stock price chart for KPIT technologies. As can

be seen, it is now in a period of consolidation for the last 6 months.. Earnings of the company will continue to drive its

growth.

5. Growth Drivers for the company

- Expanding Global EV & ADAS adoption

- Software-defined vehicles (SDVs)

- OEM outsourcing trend in R&D

- Strong deal pipeline

- Strategic acquisitions in Europe and Japan

6. Key Risks for the company

- High dependency on select large OEM clients

- Currency fluctuation (significant USD/EUR exposure)

- Talent retention & cost inflation in engineering

- Global slowdown in auto demand or tech budgets

7. Peers & Positioning for KPIT technologies in India

|

Company |

Focus Areas |

Remarks |

|

Tata Elxsi |

Auto +

Media & Healthcare |

It is

diversified with other focus areas besides auto |

|

L&T

Tech |

Broader

ER&D services |

Lower auto

focus |

|

Bosch India |

Automotive

hardware + SW |

Captive

business |

|

KPIT Tech |

100% Auto

SW + IP-led |

Pure-play

EV/ADAS exposure |

KPIT is among the few listed pure-plays on the global auto-tech transition.

Globally, the direct competitors to KPIT technologies are TTTech

Auto (Austria), Elektrobit (EB) (Germany), Vector

Informatik (Germany), ETAS GmbH (Germany), AVL List GmbH (Austria).

8. ESG & Sustainability

- Low-carbon operations (software-heavy, minimal manufacturing)

- Gender diversity and global workforce

- R&D towards sustainable mobility solutions

- CSR (Corporate Social Responsibility) in education and tech skilling

9. Disclaimer

This report is for educational purposes only and is not investment

advice. Please consult a SEBI-registered investment adviser before making any

financial decisions.

Summary Snapshot

|

Business

Strength |

High

Niche, high-demand global segment |

|

Financial

Health |

Strong

margins, growing free cash flow |

|

Scalability |

High OEM

demand and tech tailwinds |

|

Risk

Factors |

Client

concentration, global slowdown |

|

Suitable

For |

Long-term

learners of tech-driven investing |

There is automation, AI everywhere in the world and growing at a

rapid pace. KPIT technologies sets to benefit from the same.

Shailendra Kumar AMFI ARN no. -316269

"See this piggy bank. Incubate the habit of Savings. Become a millionaire."