Why NVIDIA is So Successful

- Early Bet on GPUs & Parallel Processing

- In the 2000s, NVIDIA focused on graphics processing units (GPUs), which turned out to be ideal for parallel processing, critical for AI and deep learning.

- While CPUs process sequentially, GPUs process in parallel — perfect for training AI models.

- CUDA Ecosystem (2006)

- NVIDIA launched CUDA, a proprietary platform for developers to write software that runs on its GPUs.

- This created a software + hardware ecosystem that locked in AI researchers and developers — like what Windows did for PCs.

- First-Mover Advantage in AI

- When AI research exploded post-2012, NVIDIA’s GPUs were the only real option for training large neural networks.

- Google’s DeepMind, OpenAI, Tesla, Meta — all built their early AI infrastructure on NVIDIA GPUs.

- Gaming Dominance

- NVIDIA's GeForce line remains dominant in the high-end gaming segment, with premium performance and brand recognition.

- It maintained tech leadership through constant innovation (e.g., ray tracing, DLSS).

- Data Center & Cloud Expansion

- NVIDIA pivoted from consumer GPUs to enterprise AI chips, powering cloud data centers (e.g., with A100, H100 GPUs).

- Partners include AWS, Azure, Meta, OpenAI, and Tesla — all major buyers of NVIDIA chips.

- Software & Vertical Integration

- NVIDIA built end-to-end platforms like NVIDIA DGX, Omniverse, and DRIVE (for autonomous vehicles), becoming more than a chip company.

- Their stack includes hardware, drivers, libraries, and developer tools, unlike others who focused only on chips.

- Charismatic & Strategic Leadership

- • CEO Jensen Huang has been a visionary, consistently identifying and investing in trends before they become mainstream.

Key Financial highlights

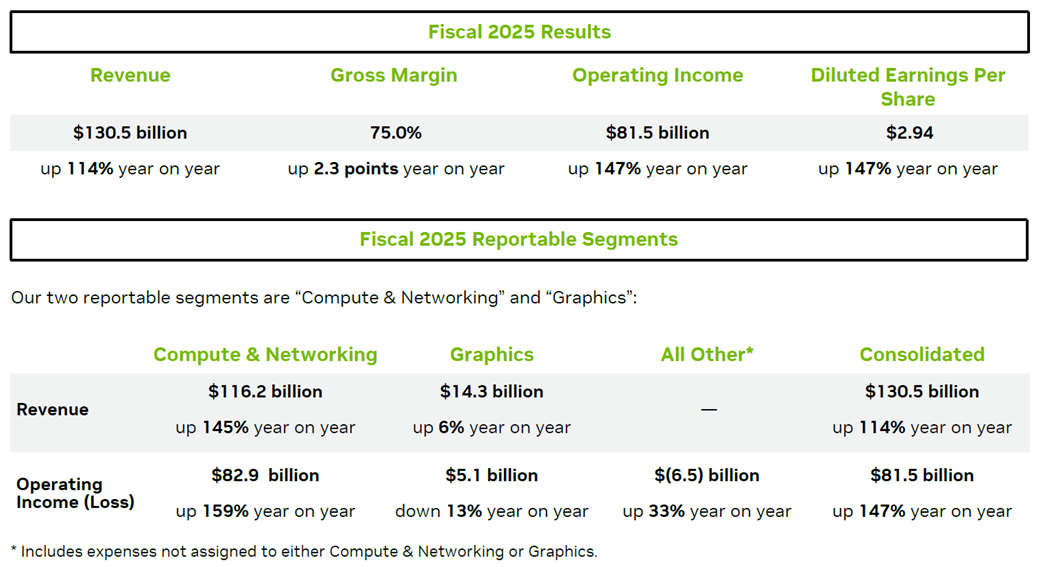

- Fiscal 2025 marked an extraordinary year for NVIDIA’s growth with revenue surging 114% year on year to $130.5 billion on strength across all market platforms.

- Growth was led by exceptional Data Center demand for Hopper architecture used for large language models, recommendation engines, and generative AI applications.

- Ethernet for AI was another key contributor, including strong uptake of Spectrum-X end-to-end ethernet platform.

- Gross margin expanded year on year to 75.0% and drove strong operating leverage with operating income rising 147% to $81.5 billion and diluted earnings per share increasing 147% to $2.94.

Sharing financial details below:

Market Cap: $4.44 trillion dollars : PE ratio: 58.72

Share price performance

In five years, the stock has gone from $12 to $182 currently which is 15 times. This is an exceptional performance.

Business Mix

Data Center revenue constitutes above 90% of revenues which includes AI data centers

Growth Drivers for NVIDIA

- AI & Machine Learning Boom

- NVIDIA’s GPU architecture (CUDA platform) is the backbone of AI training and inference.

- AI adoption across industries — healthcare, finance, autonomous driving, and robotics — is driving massive GPU demand.

- Flagship chips like H100 and upcoming B100/Blackwell architecture are becoming industry standards.

- Data Center Expansion

- Cloud service providers (AWS, Azure, Google Cloud, Oracle OCI, Alibaba Cloud) are heavily investing in NVIDIA-powered AI clusters.

- AI-specific data centers (hyperscalers + enterprises) are a major revenue driver.

- Data Center segment already surpassed Gaming as NVIDIA’s largest revenue contributor.

- Generative AI & LLM Infrastructure

- NVIDIA’s chips are essential for training large language models like ChatGPT, Gemini, Claude, etc.

- The generative AI market is projected to grow >30% CAGR over the next decade.

- NVIDIA provides end-to-end AI solutions (chips, networking, software, developer ecosystem).

- Software & Ecosystem Lock-In

- Proprietary CUDA, cuDNN, TensorRT frameworks create a deep moat.

- Developers trained in CUDA ecosystem are less likely to switch to AMD/Intel.

- NVIDIA AI Enterprise software adds recurring subscription revenues.

- High-Performance Computing (HPC) & Scientific Research

- NVIDIA GPUs are used in supercomputers, weather modelling, protein folding, and scientific simulations.

- Partnerships with government labs and research institutions expand adoption.

- New Frontiers – Omniverse, Digital Twins, and Quantum Simulation

- NVIDIA Omniverse enables 3D simulation for industries, powered by AI & real-time rendering.

- Digital twins adoption in manufacturing, smart cities, and logistics can create new demand.

- cuQuantum positions NVIDIA for hybrid classical + quantum computing future.

Key Risks

Geopolitical & Supply Chain Risks

- ⚠️Taiwan Dependence (TSMC)

- NVIDIA designs chips but outsources manufacturing to TSMC, which is based in Taiwan.

- Any disruption (e.g. China-Taiwan conflict) could halt NVIDIA’s entire supply chain.

- TSMC fabs in the U.S. and Japan are still ramping up and not yet sufficient.

- ⚠️US-China Trade War

- China makes up 20–25% of NVIDIA's data center revenue, so this is could be a major hit.

- Future sanctions could tighten further, affecting custom AI chips or software exports.

Customer Concentration Risk

- ⚠️Over-Reliance on Hyper scalers

- • Top 5 customers (e.g. Microsoft, AWS, Google, Meta, OpenAI) drive a huge portion of sales.

- • If any of them develop in-house chips (which they are), it could reduce demand for NVIDIA GPUs.

- • Example: Microsoft Maia, AWS Trainium, Google TPU, Meta MTIA — all are custom AI chips.

⚔️ Rising Competition

- ⚠️from AMD & Intel

- ⚠️Custom Silicon from Tech Giants

- ⚠️Open-source AI ecosystems

- • NVIDIA’s edge is partly due to CUDA dominance

- • However, open-source frameworks like ROCm (AMD) and OpenAI Triton are improving, challenging CUDA’s lock-in.

AI Bubble & Market Expectations

- ⚠️Valuation Risk

- • NVIDIA trades at very high multiples

- • If AI spending slows, or AI models get more compute-efficient, NVIDIA’s growth could disappoint.

- ⚠️Overbuilding Risk

- • Cloud giants are spending billions on NVIDIA GPUs.

- • But if AI use cases (like LLMs, chatbots) fail to monetize, it could lead to overcapacity and lower orders.

Valuation

- Market Cap: $4.44 trillion dollars

- PE ratio: 58.72 which is on the higher side

Investor confidence shows in the market cap, stock price and the way NVIDIA is dramatically changing the world.